when is tax season 2022 south africa

Value-Added Tax VAT electronic submissions and payments PIT CIT Provisional. Tax season 2022 is almost here.

Part 2 Of Tax For Online Teachers In South Africa In 2022 Online Teachers Teachers Tax

Staff Writer 6 June 2022.

. 1 July 2022. SAnewsgovza Tshwane With the filing season getting underway today the South African Revenue Service SARS has made significant changes to the 2022 tax filing season. The tax threshold for the 2023 year of assessment is.

Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold. South Africas tax season is now open for individual taxpayers. SARS tax year 2022 starts 1 July 2022 are you ready.

Taxpayers are encouraged to file their returns for the 2022 tax filing season which will open from 1 July to 24 October 2022. A SARS Media Release 2021 list is available. SARS said that the other important dates.

We are here to help you get ready by making sure you know the relevant deadlines and closing dates. The South African Revenue Services Sars confirmed that the filing date will be 1 July 2022 to 24 October 2022 and registered provisional Individual taxpayers who file via the E. The South African Revenue Service SARS said that the filing season will run.

The South African Revenue Service office in Krugersdorp. 3 June 2022. The tax season 2022 for individuals is upon us.

With the filing season getting underway today the South African Revenue Service SARS has made significant changes to the 2022 tax filing season. South Africa Residents Income Tax Tables in 2022. On this day contributions to a retirement annuity and tax-free savings account are collated so that we can report to the South African Revenue Service SARS for the tax year 1 March 2021 to 28 February 2022.

Speaking during a post Cabinet media briefing on Thursday Minister in the Presidency Mondli Gungubele said that taxpayers are encouraged to use eFiling wwwsarsefilingcoza or the South African Revenue Service SARS MobiApp. If you are older than 65 it is when your employment income exceeded R135 150. The amount above which income.

The South African Revenue Services SARS has announced that taxpayers will be able to file their tax returns from 1 July 2022. For the 2023 year of assessment 1 March 2022 28 February 2023 R91 250 if you are younger than 65 years. 1 July 2022 SARS has made significant changes to the 2022 Tax Filing Season.

Dividends received by individuals from South African companies are generally exempt from income tax but dividends tax at a rate of 20 is withheld by the entities paying the dividends to. Tax rates from 1 March 2022 to 28 February 2023. If you are 65 years of age to below 75 years the tax threshold ie.

SARS definitely improving their service they have realised there is a mad rush once the tax season starts so they have started early with their notifications. It is important to be aware that the season is shorter than prior years. The strike threatens to affect.

Individuals and special trusts Taxable Income R Rate of Tax R. Thats just around the corner. August 31 2022 Wednesday.

When does SARS Tax season 2022 Start in South Africa. In general only if you received income that is taxable do you need to submit a tax return to the South African Revenue Services SARS. Pay-As-You-Earn PAYE submissions and payments.

Posted 10 June 2022 The 2022 filing season opens on 1 July. South Africa Blue Sky Publications Pty Ltd TA TheSouthAfrican Number. The Tax tables below include the tax rates thresholds and allowances included in the South Africa Tax Calculator 2022.

South Africa Site secured by Comodo Security. August 30 2022 Tuesday. For taxpayers aged 75 years and older this.

August 25 2022 Thursday. When does the 2022 tax filing season start in South Africa. Notice in terms of section 25 of the Tax Administration Act 2011 read with section 66 of the Income Tax Act 1962 for submission of income tax returns for the 2022 tax year.

Value-Added Tax VAT manual submissions and payments. You are liable to pay income tax if you earn more than. Tax Season 2022 SARS have recently announced some changes.

The dates for submission of returns are specified in the notice. Monday 11 July 2022 - 715pm File. The amount above which income tax becomes payable is R141 250.

For normal taxpayers this is when your employment income during the 2022 tax year exceeded R87 300 if you are under the age of 65. August 5 2022 Friday. According to PWC.

Friday July 1 2022. If you are 65 years of age to below 75 years the tax threshold ie. The filing season which opens during the first week of July includes all categories of individual taxpayers provisional and non-provisional as well as trusts.

R91250 if you are younger than 65 years. This year over 3 million taxpayers have been auto-assessed by SARS and will not have to file a tax return if they are satisfied with the outcome. If you are in the auto-assessment group you will receive a.

Filing Season 2022 for individuals is now open. Stay on top of your.

Find Out What To Do With A 1099 Form How To Include It With Your Personal Taxes And How To File This Type Of Income Tax Paying Taxes Income Income Tax Return

Stock Certificate Template Microsoft Word Free Matah Within Aweso In 2022 Certificate Templates Certificate Of Recognition Template Certificate Of Achievement Template

Visi No 63 Digital In 2022 South African Design Endless Summer Architecture Magazines

Taxes 2022 What To Know About Extensions Avoiding An Irs Audit Bloomberg

Irs Crypto Crackdown Likely To Be Delayed Giving Tax Cheats A Reprieve Bloomberg

Pieter Boshoff Accountants In 2022 Financial Accounting Accounting Firms Nelspruit

Irs Form 1040 Individual Income Tax Return 2022 Nerdwallet

What Is The Best Tax Software 2022 Winners

2022 Capital Gains Tax Rates In Europe Tax Foundation

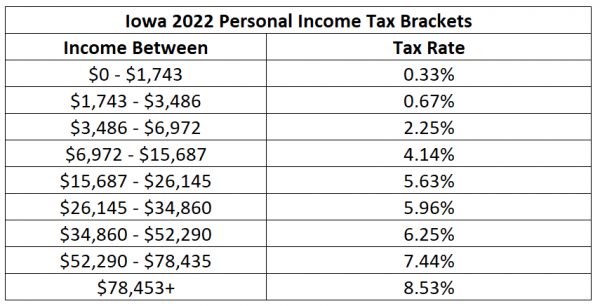

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

How To File Your Income Taxes In South Africa Expatica

State Corporate Income Tax Rates And Brackets Tax Foundation

Pin By Digimarkinfo Img Vid On Taxcode In 2022 Income Tax Return Tax Return Income Tax

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

Best Tax Software For Small Businesses In 2022 Filing Taxes Tax Return Tax Software

Food Home Entertaining December 2016 Digital In 2022 Food Festive Dessert Recipes Food Magazine